Most people don’t apply for a home loan many times in their life. Even if you’re just renovating or refinancing, it may have been 3–10 years since you last applied for a home loan and there have been a lot of changes in the lending market over that period so that what used to be a relatively straight forward application process can now be a frustrating, and potentially costly, experience.

What has caused the changes in the market?

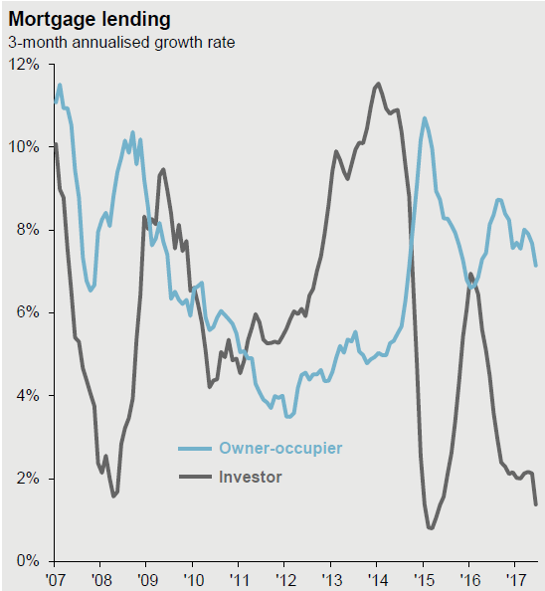

In 2014 the Reserve Bank got concerned about the sharp rise in house prices and requested APRA, the government watchdog for the banks, to tighten the ‘prudential’ lending regulations and hopefully slow the market, so APRA limited the banks to a maximum of 10% growth in investor lending over a 12-month period.

To meet these new requirements the banks raised interest rates on investment loans in some cases by as much as 1% almost overnight, as well as significantly tightening their loan application assessment policies. Chart one shows the impact that this has had on the growth rate of investor lending.

Chart1: Investor lending slowed sharply after APRA tightened regulations

Source: JP Morgan

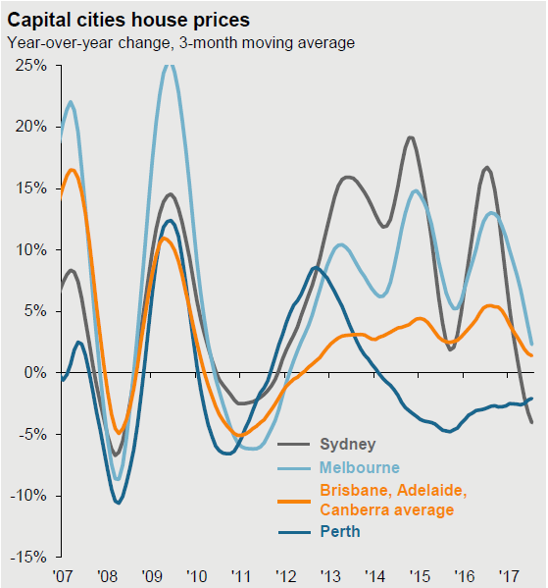

Then in April 2017 APRA introduced additional macro-prudential measures which capped interest-only lending at 30% of all new loans issued. Around six months after that was introduced, home prices in Australia’s major east-coast housing markets began to decline. Chart two shows the significant fall in year on year house prices in Sydney and Melbourne particularly.

Chart 2: Melbourne and Sydney home prices started to decline after APRA restricted interest-only loans

Source: JP Morgan

Throughout this period APRA has also been working closely with banks to develop stricter underwriting standards for both investor and owner-occupied loans. This tightening, combined with the public shaming at the Royal Commission into Financial Misconduct, has forced banks to take note.

How has this affected the lending process?

There is no doubt the regulatory changes have been introduced to make sure our financial system remains unquestionably strong, however, for anyone intending to apply for a home loan there are consequences you should be aware of.

1. More paperwork – In the past lenders have been able to accept that what you entered on your application was correct, but today they will require you to verify much more of your financial situation with documentary evidence in the form of bank statements. Often the submission of one statement leads to further requests which can be frustrating for all involved.

2. More questions – Banks are required by their regulators to keep evidence explaining why they assessed your application in a certain way. While something may seem obvious to you as the borrower, the banks may request an explanation in writing to ensure they have documentary evidence.

3. Living expenses – Currently banks ask that you estimate your living expenses and then take the higher of your estimate or the Household Expenditure Method (HEM). HEM is a national standard based on a few things, including where the borrower lives and the number of dependent children, and then assumes a basic standard of living. History has shown borrowers generally have a surprisingly vague understanding of their monthly living expenses and tend to underestimate this figure, and banks are now starting to require more evidence in the form of transaction or credit card statements to prove actual expenditure, rather than simply taking an estimate. A review of the HEM model is also underway.

4. Inflexible – Each bank has a list of criteria that need to be met to gain loan approval and these are documented in the bank’s lending policy. Banks have been instructed by APRA to strictly adhere to these policies and make very few exceptions. As a result we have seen an increasing number of declined applications for circumstances that may seem like common sense to the borrower, but unfortunately do not meet the specific requirements of the lender’s policy guide. Each bank’s policy guide is different, and it pays to speak to someone who has knowledge of these subtleties.

5. Principal and Interest (P&I) repayment – with such a regulatory emphasis on investment and interest only loans, it doesn’t take much to realise that much of the recent lending growth has come in the form of P&I repayment. Depending on your personal circumstances and lending objectives, you may consider paying principle and interest (P&I) instead of choosing an interest only loan.

These are just a few examples in which applying for a home loan has become significantly more difficult in recent times, but they highlight the importance of speaking to a professional to ensure you have the right structure and preapproval before you make an offer on a property. Where appropriate, we can also help you to apply with a non-bank lender that is not affected by APRA’s restrictions.